Loan Origination and Securitization Intelligence for Asset Backed Securities Comprised of Loans to Young, Thin File Borrowers

Our data provides a detailed analysis of educational attainment to career outcomes, and includes student loan repayment rates. The data represent the trajectory of young persons on a continuum from high school, through college, and then 10 years into the labor market. The purpose of these data is to enable all parties involved in loan origination, constructors of loan portfolios and Asset Backed Securities (including SLABS), and investors in ABS to accurately assess risk of the underlying securities.

Our data are stratified by individual colleges and academic majors, and specifically provides:

- Quantified labor market attachment – loss of employment is almost always the precipitating cause of delinquencies and defaults for persons under the age of 30

- Probability of non-repayment of student loan, credit card, auto loan, cell phone plan

- Occupational outcomes with earnings

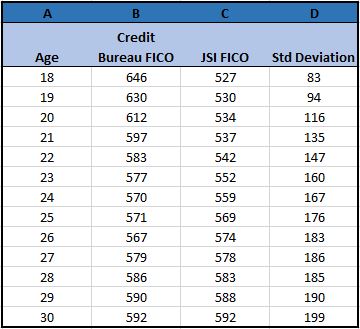

Loan originators and those who are downstream of the originators are ‘flying blind’ regarding the credit-worthiness of young, thin file borrowers. This simple table shows the delta between the major credit bureaus guesstimates of FICO scores, and reality.

A - Age of persons

B - Average FICO scores as known by the 3 credit bureaus (18 year olds are issued a score of 650)

C - Average FICO scores generated by JSI’s credit model

D - Standard deviation from JSI’s FICO scores. Our database represents the basis for the std devs.

The sample files below from our 2 data programs provide a roadmap to understanding how our data enables non-repayment risk assessment of loans.

Education to Occupation Mapping - a data table that is foundational to developing a strategy for targeting future borrowers. The table presents a global view of how young people progress through college, enter the workforce, and their first 10 years of employment, including salary data. By analyzing the continuum of educational tracks to career outcomes, the clarity of who will become great lending prospects, and who will struggle with student debt, is immediately evident. The Education to Occupation Mapping data table is a true platform of intelligence on which a cost effective, targeted customer acquisition strategy can be developed.College Credit Data Program– identify the specific colleges you’ll focus on in a targeted marketing campaign. With 1240 colleges in our database, you’ll be able to identify the colleges that have the students you want to target, as well as the students who will pose too much of a credit risk.